In the cryptocurrency landscape, one of the most relevant debates revolves around the Staff Accounting Bulletin No. 121 (SAB 121), issued by the U.S. Securities and Exchange Commission (SEC) in 2022. This bulletin has been an obstacle to Bitcoin’s integration into the traditional financial system. However, recent political developments could drastically change this scenario.

What Is SAB 121 and Why Does It Matter?

SAB 121 was designed to establish accounting standards for companies that safeguard cryptocurrencies on behalf of their customers. Although it is not formal legislation, the bulletin requires companies to comply with certain regulatory expectations under the threat of strict audits and possible sanctions.

The main provisions of SAB 121 include:

- Recording crypto assets on balance sheets: Customer assets must be reported as both assets and liabilities, introducing additional risks for financial institutions.

- Risk disclosures: Companies must extensively detail the risks associated with the crypto assets they manage.

These measures increased operational costs and fiduciary risks for banks, discouraging them from engaging in Bitcoin and other crypto asset custody.

The Impact of SAB 121 on the Banking Sector

Since its implementation, SAB 121 has led banks, in general, to avoid offering services related to cryptocurrencies. This has limited consumer access to innovative services such as:

- Secure Bitcoin custody.

- Bitcoin-backed loans, enabling liquidity without selling the asset.

- Integrated solutions for managing both traditional and digital assets on a single platform.

In essence, SAB 121 stunted the growth of the cryptocurrency market within the traditional financial system, limiting consumer options and Bitcoin’s potential for mass adoption.

Congressional Intervention and Biden’s Veto

The SEC’s regulatory approach through SAB 121 has faced criticism from both the crypto industry and Congress. In 2024, the House of Representatives and the Senate voted to repeal the bulletin, arguing that the SEC had overstepped its authority by imposing new rules without going through a formal legislative process.

However, President Joe Biden vetoed Congress’ decision, reinstating SAB 121. This move was interpreted by many as a hostile stance toward cryptocurrencies, fueling discontent among voters and the industry.

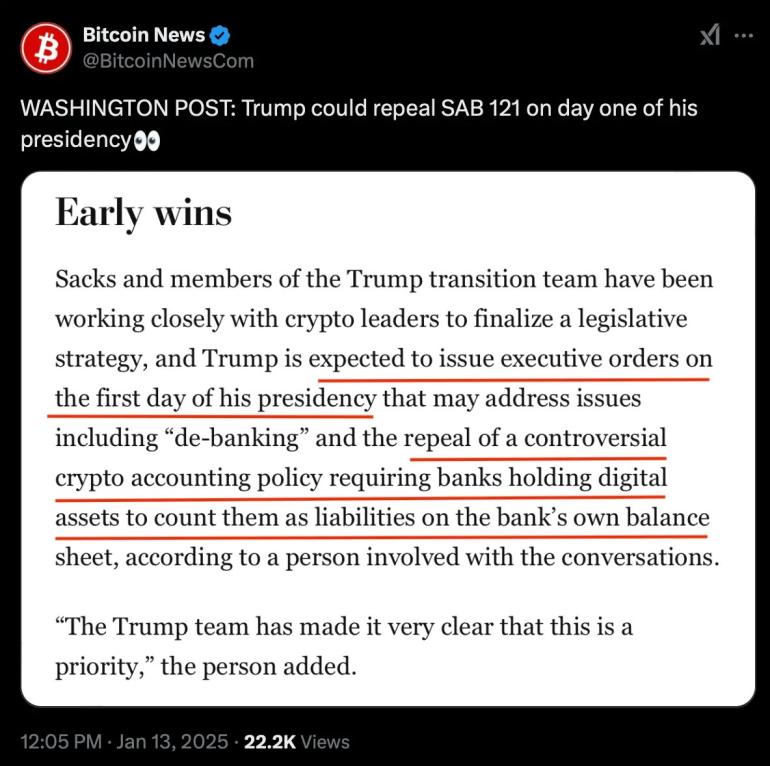

The Potential Repeal of SAB 121 Under Trump

With Donald Trump’s upcoming return to the presidency, it is expected that he will issue an executive order to repeal SAB 121. Trump, who has shown a favorable approach to cryptocurrencies, has promised to eliminate regulatory restrictions that he considers detrimental to financial innovation.

If SAB 121 is repealed, banks could begin offering a range of Bitcoin-related services, including:

- Direct custody: Consumers could buy, store, and manage Bitcoin through their traditional bank accounts.

- Bitcoin-backed loans: Loans with more favorable terms would become possible without the need to sell Bitcoin.

- Regulatory security: Crypto assets held by globally significant banks would have greater oversight, providing users with peace of mind.

What Does This Mean for Bitcoin Adoption?

The repeal of SAB 121 could act as a catalyst for Bitcoin’s mass adoption, but it also raises uncertainties. Some potential outcomes include:

- Increased trust in Bitcoin: The participation of recognized banks could legitimize Bitcoin in the eyes of a broader audience.

- Acceleration of innovation: New financial products, such as insurance and bundled services, could emerge around Bitcoin.

- Regulatory and volatility risks: Without a clear framework, the market could face instability and unexpected challenges.

While these possibilities are encouraging, it is important to remember that the success of these initiatives depends on factors such as banks’ willingness to invest in crypto infrastructure and the future political landscape.

Conclusion

SAB 121 is a clear example of how regulation can either hinder or accelerate the adoption of new financial technologies. Its eventual repeal under a new administration could signal the beginning of a new era for Bitcoin, integrating it more deeply into the traditional financial system.

However, these are only possibilities. Practical implementation and long-term effects will depend on how banks, regulators, and consumers navigate this constantly evolving landscape.