The Foundry mining pool, based in the U.S., successfully mined seven consecutive blocks last weekend. This event has reignited the debate on Bitcoin's decentralization, particularly regarding mining pools and block generation.

What is a Mining Pool and Why is it Important?

To understand the significance of this event, it is essential to comprehend how mining pools work. Solo mining involves a high degree of uncertainty, as each mined block depends on luck. In contrast, pools allow multiple miners to combine their computing power, reducing income variability and ensuring more stable payments.

Every time a miner finds a block, they receive the full block reward (3.125 BTC + transaction fees). However, since global competition is fierce, solo mining is practically unfeasible without a massive infrastructure of mining equipment. For this reason, almost all miners use pools, distributing earnings proportionally to their contribution.

Are Mining Pools a Threat to Bitcoin's Decentralization?

At first glance, the concentration of power in certain pools may seem like a problem for decentralization. However, they do not represent a critical centralization point due to several factors:

- If a pool decides to censor transactions, miners can immediately redirect their computing power to another pool.

- If a single pool accumulates 51% of the hashrate, miners would be incentivized to leave it to prevent risks to the network.

- Pools do not own or control the hardware or energy used for mining.

That said, if you are a miner and concerned about pool centralization, you can choose to direct your hashrate to more decentralized alternatives, such as the Blockware pool.

Transaction Fees at Historically Low Levels

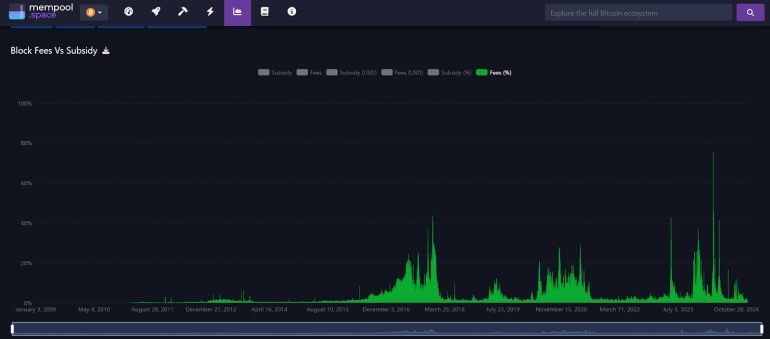

Another crucial point is the current state of Bitcoin's transaction fees. Currently, fees account for approximately 1.5% of the reward for each block, a level not seen since the 2022 bear market.

This phenomenon is unusual in a bull market, as previous cycles saw increased on-chain activity driving up fees significantly. However, much of today's trading volume comes from ETFs and securitized products, reducing pressure on mainnet fees.

Despite this, if this bull market reaches a "parabolic top," a sharp increase in transaction fees is likely. When Bitcoin's price surges, holders with large amounts in cold storage may move their funds on-chain to sell, increasing fees.

For now, the fact that fees have yet to rise significantly is a sign that Bitcoin's bull rally still has room to grow.