The price of Bitcoin (BTC) has remained relatively flat for September and the strong decline in altcoin and DeFi token prices seems to be making the situation worse for many investors.

Despite this lack of bullish momentum, on-chain data reveals that new participants are joining the Bitcoin network at an alarming rate.

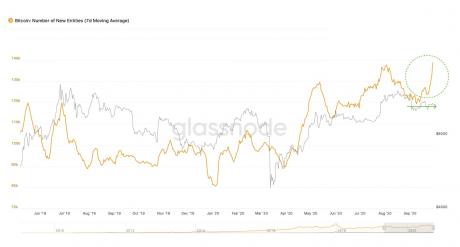

Although the price has failed to react to the sharp inflow of new participants, on-chain analyst Willy Woo believes that this is a strongly bullish sign. Sept. 30 Woo tweeted:

We're seeing a spike in activity by new participants coming into BTC not yet reflected in price, it doesn't happen often. This is what traders call a divergence, in this case it's obviously bullish

As shown by the chart above, the number of new entities joining the Bitcoin network has been rising steeply since last week and the metric clearly surpassed the numbers recorded in August. The metric measures the number of clusters (wallets) owned by a given person or group.

What is drawing new participants in?

Some analysts believe that the surge in new entities could partially be attributed to the strong pullback in DeFi tokens and altcoins. In the past 30 days many have registered double-digit losses and this may have left investors looking for safer alternatives in the crypto market.

While the price of Bitcoin has repeatedly failed to break through the $11,000 level, it has remained stable above $10,000 for the past month.

Given the current economic and political chaos sweeping through the U.S. and other countries impacted by the coronavirus pandemic, Bitcoin’s price stability strengthens the argument that Bitcoin is a solid store of value.

Although the U.S. dollar has remained the most sought after asset in the face of the recent financial crisis, it’s possible that a second wave of coronavirus infections may negatively impact the global economy. Such an event would likely prod investors to invest in assets like gold and Bitcoin, especially if the dollar loses strength.

Published by: Coin Telegraph