This week, David Sacks held his first press conference on digital assets. Many expected a major announcement about Bitcoin reserves, but Sacks only mentioned that he is still "studying the feasibility of one." However, the real headline was his comments on stablecoins.

Sacks stated that they are working to provide more regulatory clarity for stablecoins and mentioned the GENIUS Act by Senator Bill Hagerty, which proposes a framework for payment stablecoins. But what really sparked debate were his statements about their impact on Treasury bonds.

Stablecoins have the potential to ensure the dominance of the US dollar internationally, increase its digital usage as the world’s reserve currency, and, in the process, create potentially trillions of dollars in demand for US Treasury bonds, which could lower long-term interest rates.

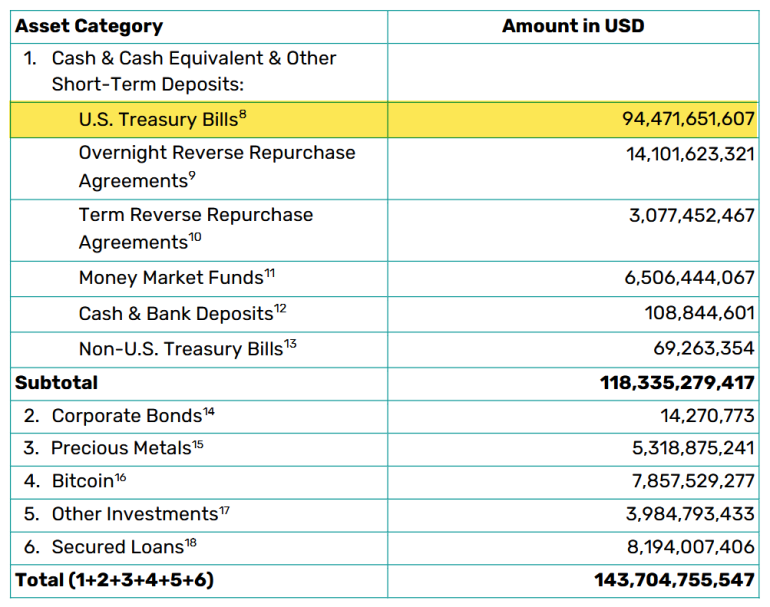

It is no secret that stablecoins today represent a massive source of demand for short-term Treasury bonds. Like money market funds, issuers such as Tether must hold liquid reserves for redemptions. Their latest report shows they hold $94 billion in T-bills, making them the sixth-largest foreign holder, just behind the UK.

The problem is that short-term T-bills are NOT the same as long-term Treasury bonds. The idea that stablecoins could drive demand for long-term bonds and lower interest rates, as Sacks suggests, does not make much sense.

Tether CEO Paolo Ardoino recently dismissed the idea that Tether could hold long-term Treasury bonds. According to him, "the most important thing for a stablecoin is to be able to liquidate reserves immediately to pay users". He added that holding long-term government debt poses liquidity, geopolitical, and financial risks. Instead, he prefers Bitcoin as a long-term reserve asset—and he backs this up with action: Tether now holds $7.8 billion in Bitcoin in its reserves.

Think about it: why would stablecoin issuers want to hold illiquid 10- or 20-year bonds when they can simply have short-term T-bills? The only way this could happen is if the government mandated it by law.

But here’s the issue: this would make stablecoin redemptions more difficult, adding more risk to the market.

Why would the government do this? Desperation. They need to artificially create demand for Treasury bonds to keep long-term interest rates low and continue financing multi-trillion-dollar deficits. Even Treasury Secretary Scott Bessent admitted this, stating that the Trump administration is focused on keeping the 10-year Treasury yield low.

It seems the government sees stablecoins as a tool for their strategy, but if they force issuers to hold long-term bonds, beware: these stablecoins could end up being anything but stable.