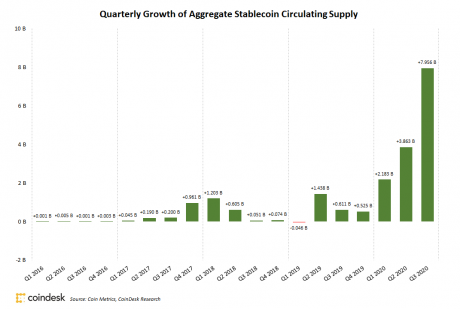

Nearly $8 billion were added to the aggregate supply of stablecoins in the past three months, nearly doubling the industry’s supply of crypto dollars from $11.9B at the end of Q2 to just below $20B on Wednesday, according to Coin Metrics data.

- “2020 seems to be the year of stablecoins,” said Paolo Ardoino, CTO of Tether, the company behind the largest stablecoin by market capitalization, tether, in a private message to CoinDesk.

- Since this time last year, the supply of stablecoins has exploded by more than 1,200 percent.

- In May, the total stablecoin supply passed $10 billion for the first time, as CoinDesk reported, closing Q2 just below $12 billion. Aggregate supply closed Q3 at $19.87 billion, nearly breaking above $20 billion on Sunday, according to data from Coin Metrics.

- In addition to supply growth, Q3 saw stablecoins grow across multiple blockchains as Tether added support for both OmiseGo and Solana protocols. USDC, the second-largest stablecoin by market capitalization, expanded to the Algorand network, as CoinDesk reported.

- USDC also joined tether as the only stablecoins with market capitalizations greater than $1 billion after adding $1.5 billion since the end of June.

- According to Ardoino, the primary drivers of growth in the past quarter were the “explosion of decentralized finance (DeFi)” and a growing number of hedge funds and over-the-counter trading desks moving funds to tether for “faster arbitrage and reactions to market movements.”

- Whether this stablecoin growth will continue is hard to predict, Ardoino said. But as the utility of stablecoins like tether continues to expand, he expects overall growth to continue for at least the next few months.

Published in: Coindesk