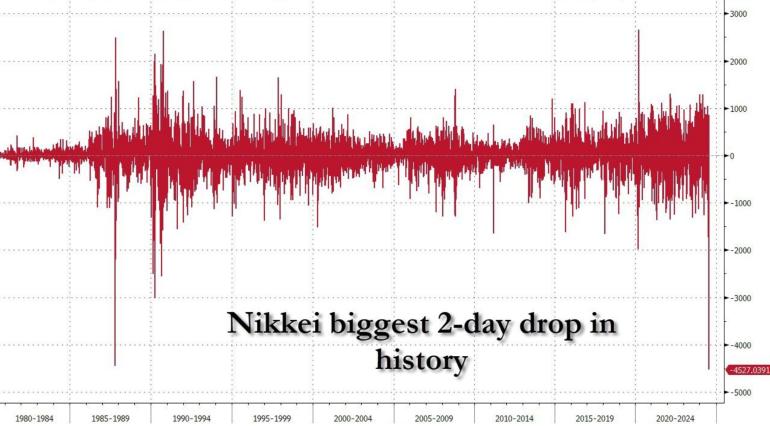

Last week began with a significant drop in the markets. The Nasdaq fell by 6%, the Dow lost a thousand points, and Bitcoin dropped below $50,000 for the first time since February. However, the biggest decline occurred in the Japanese stock market, where the Nikkei suffered the second-largest single-day drop in its history. Considering two days, it was the worst drop ever.

After this, the markets have partially recovered, although losses still persist. These types of events remind us of the so-called "Minsky Moments," a concept created by economist Hyman Minsky. Minsky argued that stability breeds instability. What Minsky proposed is that when there is little volatility in the markets and periods of stability, investors tend to become complacent, which in turn fosters ambition. When everything seems safe and there is no volatility, investors decide to invest more and more in risky assets. After a while of investing in risky assets, price bubbles form that eventually burst. This is what is known as a "Minsky Moment."

In the case of the U.S. stock market, what happened last week and the previous Monday was the fourth most volatile day in history, following the Black Monday of 1987, the global financial crisis of 2008, and the 2020 pandemic.

Why did people sell so much in the markets? It is estimated that there are many contributing factors. Among them, U.S. employment figures were below expectations. The unemployment rate was expected to be 4.1%, but it actually reached 4.3%.

This, along with inflation figures and the possibility that interest rates will remain high, created fear in the market. However, it is believed that the major factor was the Yen Carry Trade.

To explain what the Carry Trade is, consider the following example:

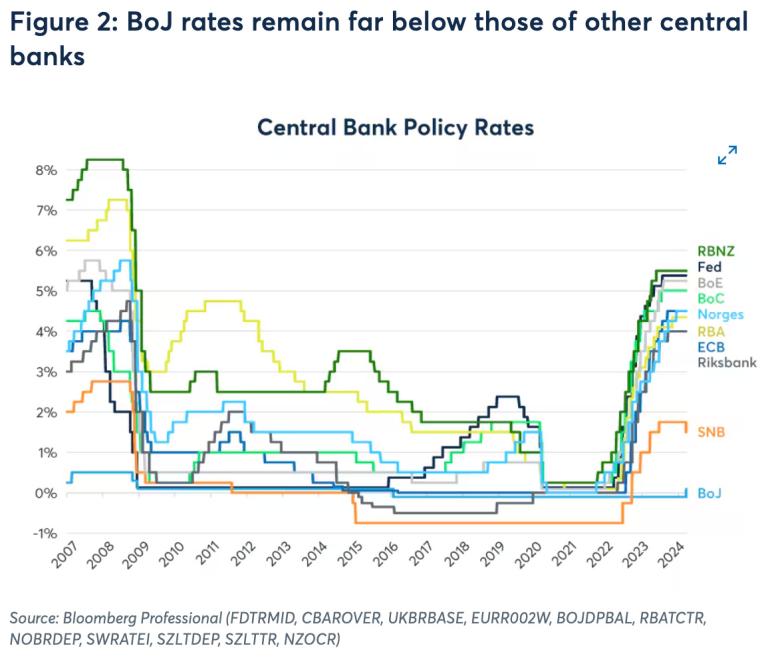

- First, an investor borrows yen at almost 0% interest, due to Japan's monetary policy, which has kept interest rates very low for many years.

- Second, those yen are converted into dollars.

- Third, those dollars are invested in U.S. bonds or stocks in the U.S. stock market.

- Fourth, they earn money because the returns from the stocks or bonds exceed the interest paid on the borrowed yen.

If they need to close their positions, what they have to do is sell their bonds or stocks to get dollars, then convert those dollars into yen, and with the yen, pay back the money they borrowed in Japan. This is how the Carry Trade works.

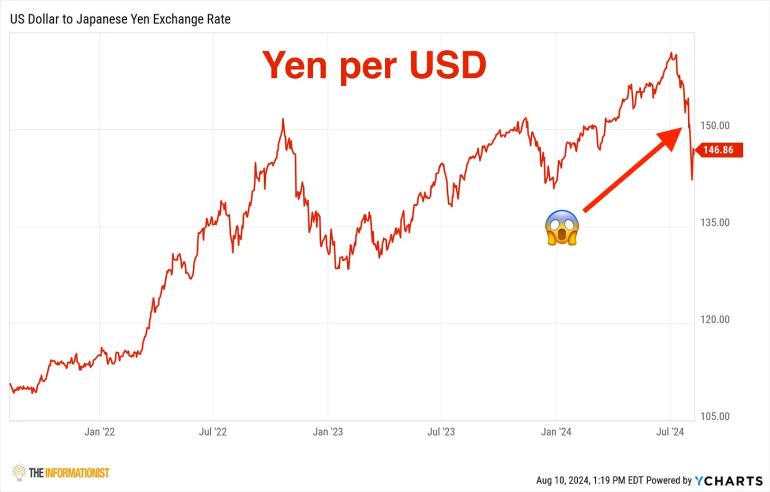

This strategy depends on the exchange rate between the yen and the dollar remaining stable or even the yen continuing to depreciate against the dollar. The yen had been falling against the dollar for some time, which made this a very attractive investment option, especially since the Bank of Japan has kept its interest rates low for many years.

Why? Japan has the highest debt-to-GDP ratio in the world. Japan's debt is the highest relative to its Gross Domestic Product. But Japan does not have the same inflation problem that has arisen in the United States, and Japan has accumulated many external assets over the years, including a large amount of U.S. Treasury bonds.

For these reasons, interest rates in Japan have been very low for a long time, and it seemed that this would not change. Investors believed that Japan would not raise interest rates and that the yen would continue to depreciate against the dollar. This is what eventually leads to a "Minsky Moment."

What happened? The yen had been losing value against the dollar for several months, as shown in the graph. There was a need for the Bank of Japan to intervene, and what they did was suddenly announce an increase in the interest rate from 0.1% to 0.25%.

One might think that such a small interest rate increase shouldn't cause such a big impact on the markets, but as soon as this change was announced, all the investors who had borrowed yen to invest in other countries began to take notice. The Bank of Japan's news caused the yen to start gaining value against the dollar. If the yen gains value, the Carry Trade is no longer as attractive, so the correct move is to close the position, sell what was bought with dollars, whether Bitcoin, stocks in the stock market, or U.S. Treasury bonds, convert those dollars into yen, and with those yen, pay off the loans made.

In this process of converting dollars into yen, the yen started to see more demand and, therefore, increased in price. In a matter of a few hours, the yen went from 138-139 yen per dollar to 146-147 yen per dollar.

What assets are usually sold off the fastest in events like this, where markets drop and massive sell-offs occur? Obviously, the most liquid assets are sold. This happened over the weekend, and since Bitcoin is completely decentralized and its market operates 24 hours a day, 7 days a week, it was easy to foresee what would happen. During Saturday and Sunday, many investors started selling assets to get the dollars they needed to close their positions, and one of those assets was Bitcoin, which was one of the first to fall. By Monday, the sell-off continued with other assets, which explains the drop in the Nasdaq, the Dow, and other stock markets around the world.

What will happen in the future? There are estimates that most of the Yen Carry Trade positions have already been closed. Some reports suggest that 50% of the Carry Trade has been eliminated, but another 50% remains, so we will see how the markets develop in the coming weeks. This is not something that will be resolved quickly. In fact, when something similar happened in 2007 during the global financial crisis, it took between 100 and 200 days for the markets to normalize. It is not known if it will take the same amount of time this time, but some estimate that most of the Carry Trade has already been closed.

Regarding the size of the Carry Trade, there are also various estimates. Deutsche Bank believes that around $20 trillion was involved in the Carry Trade, although others believe that this figure is more conservative and that it could have been up to $5 trillion. It is still a huge amount of money, and that's why we saw the market decline. This shows how interconnected global markets are and how events in Japan can influence markets in the United States and other countries.

Financial crises seem to be happening more and more frequently, reflecting the growing fragility of the market. This instability in the traditional financial system highlights the importance of the new financial system being built and gaining its place with the creation of Bitcoin.