A few days ago, the stock market suffered a sharp decline, sparking predictions of a potential financial collapse. However, history has shown us that the more people talk about an imminent crisis, the less likely it is to actually happen.

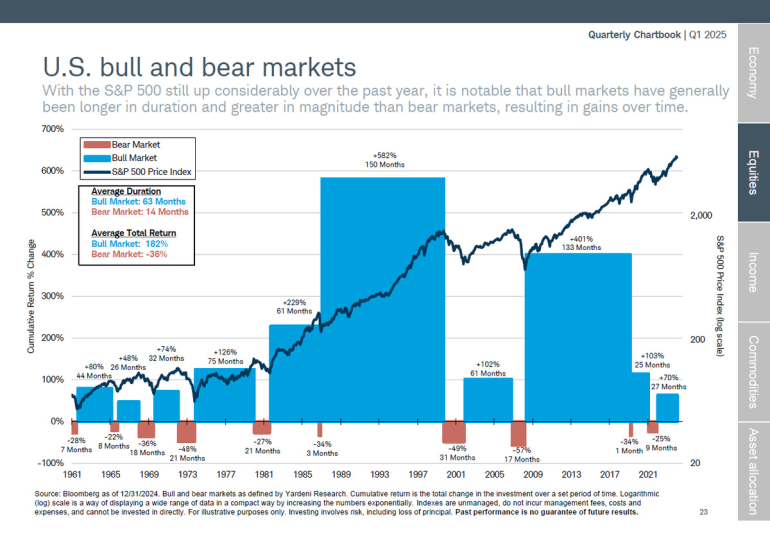

Now, hypothetically speaking, if a market crash were to occur, what should an investor do? Peter Mallouk, CEO of Creative Planning, shared a chart demonstrating that bear markets are short-lived and relatively small compared to bull markets. The key to navigating them is to keep buying strong assets for the long term.

Data Supports the Bullish Strategy

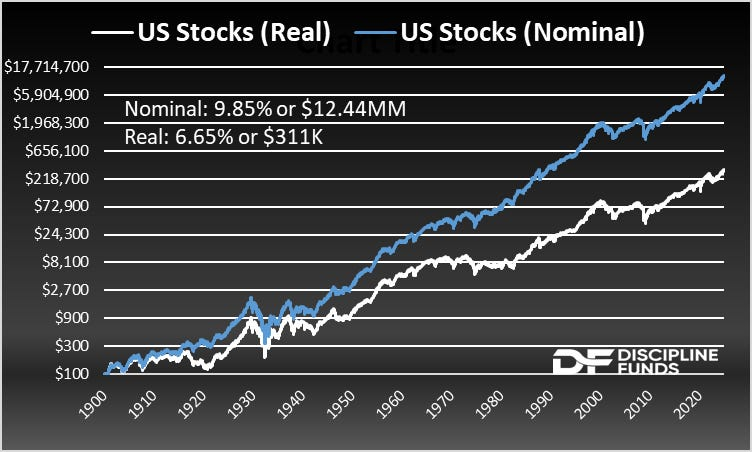

Cullen Roche, founder of Discipline Funds, analyzed stock market returns over the past 125 years and found that:

- Real return on U.S. stocks: 6.65% per year

- Nominal return: 9.85% per year

This means that due to inflation, most investors are only capturing two-thirds of the gains they believe they are making. As Roche aptly put it, "Inflation is the highest fee of them all."

Donald Trump's Role in the Economy

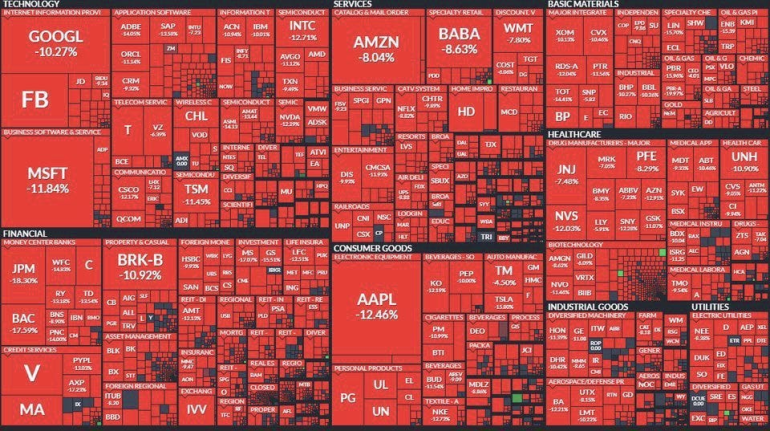

In the recent stock market downturn, approximately $1.5 trillion was wiped out from the U.S. market, a figure comparable to Spain's GDP. Despite widespread concern, one key factor is influencing markets: Donald Trump is back in the White House.

Trump measures economic success by the growth of the stock market and Bitcoin's price. To prevent a crisis during his administration, he is advocating for lower interest rates and strengthening relationships with corporate leaders.

Pessimism Has Never Been a Winning Strategy

Financial markets have repeatedly shown that, in the long run, betting against the U.S. economy is a bad decision. While analysts like Nassim Taleb predict an imminent crash, history proves that bullish investors are the ones who truly make money over time.

The U.S. government continues to add $1 trillion to the national debt every 100 days, which paradoxically increases market liquidity and supports the growth of stocks and Bitcoin.

In a period of accelerated innovation and unprecedented public spending, there is no reason to believe that this time will be different. The market continues its upward trajectory, regardless of catastrophic predictions.