The Bitcoin exchange-traded fund (ETF) ecosystem continues to evolve, and Nasdaq has taken a key step to enhance its operational efficiency. The exchange has submitted a proposal to the U.S. Securities and Exchange Commission (SEC) to allow "in-kind" redemptions for BlackRock's iShares Bitcoin Trust (IBIT). If approved, this change could reduce costs and make these funds more attractive to institutional investors.

What Are "In-Kind" Redemptions?

Currently, Bitcoin ETFs operate under a cash redemption model, where authorized participants (APs) must sell Bitcoin to obtain cash before withdrawing their shares. Under the proposed system, APs would be able to exchange ETF shares directly for Bitcoin, without converting assets into cash.

This change will not directly impact retail investors, but by optimizing the process for institutions, it could lower costs and improve market stability.

Why This Change Now?

Since the approval of Bitcoin ETFs in January 2024, the cash redemption model has been the standard due to regulatory concerns. However, with the growing success of these funds and a more favorable environment for digital asset innovation, Nasdaq and BlackRock see this as the right time to adopt a more efficient structure.

Benefits of "In-Kind" Redemptions

This model brings several key advantages to the Bitcoin ETF market:

- Greater operational efficiency: Eliminates unnecessary steps in the redemption process, reducing costs and execution time.

- Tax advantages: By avoiding Bitcoin sales, "in-kind" redemptions minimize capital gains distributions, benefiting institutional investors.

- Lower market impact: Reduced Bitcoin sell pressure could help stabilize its price, improving asset liquidity.

A More Favorable Regulatory Environment

This move comes in a context of regulatory changes that have boosted the development of digital assets. The recent repeal of Staff Accounting Bulletin 121 (SAB 121) has removed barriers preventing banks from offering cryptocurrency custody services, paving the way for innovative models like Nasdaq’s proposal.

BlackRock: A Market Leader

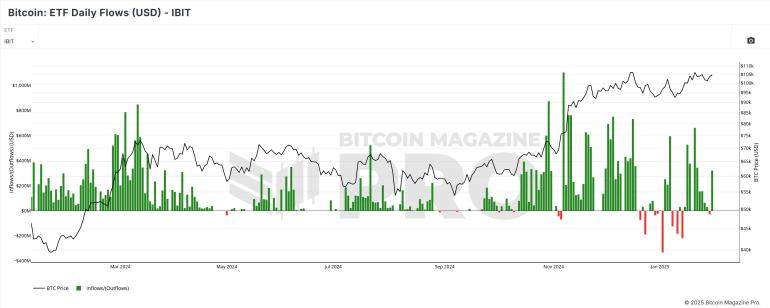

BlackRock’s iShares Bitcoin Trust has dominated the Bitcoin ETF market since its launch in 2024, accumulating over $60 billion in investment inflows. Implementing "in-kind" redemptions could further strengthen its position, attracting more institutional participation.

Conclusion

Nasdaq’s proposal to allow "in-kind" redemptions for BlackRock’s Bitcoin ETF could mark a milestone in the evolution of these financial products. By reducing costs, improving efficiency, and lowering Bitcoin sell pressure, this measure not only benefits institutional investors but also has the potential to make the market more robust and attractive for all.

If the SEC approves this change, we could be witnessing a new phase in the maturation of the Bitcoin ETF market, with greater adoption and growth on the horizon.