This week, reports surfaced that the Central Bank of the Czech Republic is evaluating the possibility of adding Bitcoin to its reserves. The governor of the entity described Bitcoin as an "interesting asset for a large portfolio", highlighting its lack of correlation with bonds.

Although the bank is still in the analysis and discussion phase, such moves could generate a chain reaction in the global financial sector. If foreign central banks start accumulating Bitcoin, this could pressure the United States to establish its own strategic Bitcoin reserve.

The Game Theory of Bitcoin in Real Time

This is a clear example of Bitcoin's game theory in action. If one central bank starts buying, others will have no choice but to react to avoid falling behind. With the repeal of SAB-121, the next logical step would be for the U.S. Federal Reserve to update its policy to allow banks to include Bitcoin on their balance sheets.

Nations and Leaders Moving Towards Bitcoin

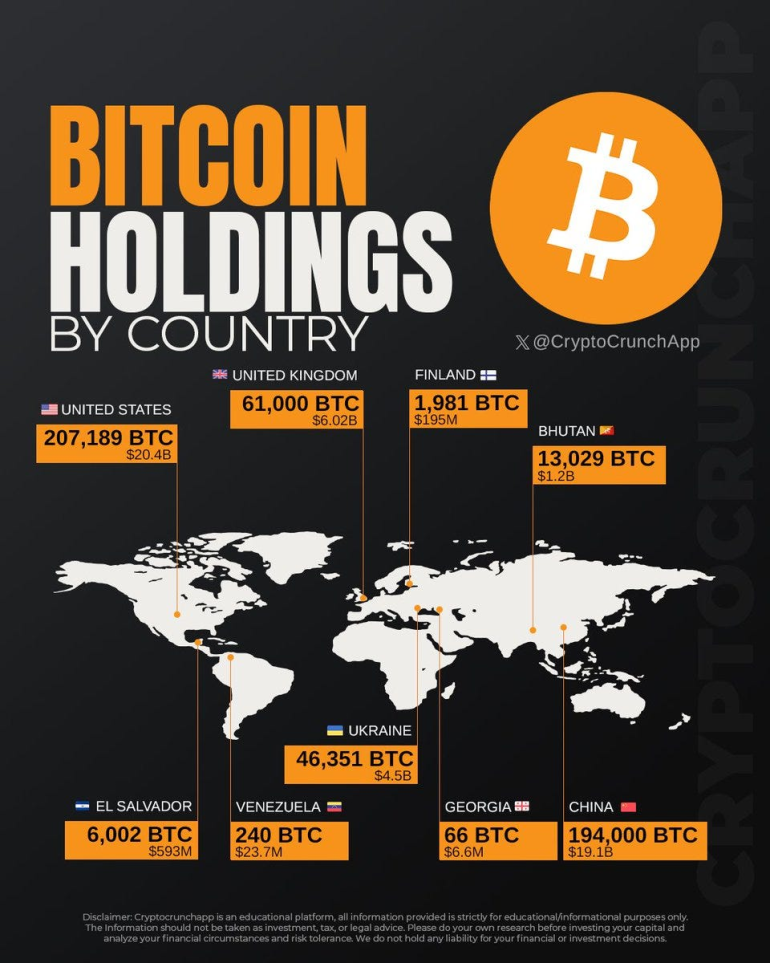

The Financial Times published an article titled "The Head of the Czech Central Bank Wants to Buy Billions of Euros in Bitcoin", which may surprise many investors. However, countries like El Salvador and Bhutan have already taken steps in this direction:

- El Salvador holds hundreds of millions of dollars in Bitcoin and continues buying at least one Bitcoin per day.

- Bhutan has approximately $1.3 billion in Bitcoin, which accounts for almost 50% of its GDP.

- Russia, under the leadership of Vladimir Putin, has explored Bitcoin mining and its use in international transactions.

Additionally, Donald Trump has openly discussed his plans to establish a strategic Bitcoin reserve for the U.S.. With so many actors entering the game, it is likely that several countries are already buying Bitcoin without announcing it to avoid driving up its price before completing their acquisitions.

The Czech Central Bank and Its Bold Proposal

The most relevant aspects of the Czech central bank's announcement are:

- The proposal comes directly from the governor, not from a lower-level official.

- The suggested allocation percentage is 5%, significantly higher than the 1-2% typically considered by other central banks.

According to their analysis, Bitcoin is an attractive asset for reserve diversification due to its zero correlation with bonds.

Will 2025 Be Marked by Bitcoin Adoption?

If more countries begin buying Bitcoin in large quantities, we could be in for a very interesting 2025. For years, Bitcoin advocates have claimed that nation-states would adopt Bitcoin. Now, it seems that this prediction is coming true.

The time for Bitcoin has arrived, and countries will not stay on the sidelines for much longer.